Other Law School Policies

In This Section

- Academic Policies Guide

- Campus Access

- Course Materials

- Attendance

- Accommodations

- For Non-Degree Students

Academic Policies Guide

The portion of our website relating to summer courses does not contain all academic policies applicable to summer students. Please refer to the Academic Policies Guide and general NYU policies.

Campus Access

If you plan to visit campus to attend class meetings or use University resources, you must obtain an NYU ID Card.

Course Materials

-

Brightspace

-

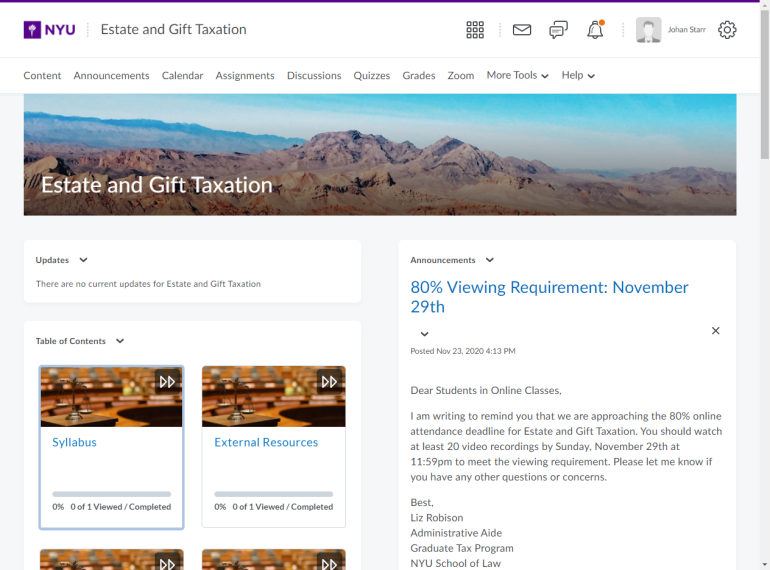

Once you are officially enrolled and the semester begins, you can access your course websites in Brightspace, NYU's online course management system. You will access Brightspace through NYU Home, a portal for NYU's online resources.

Log into NYU Home with your NetID (assigned to you when by NYU) and password.

NYU Home opens on your "Favorites" screen. Each resource is displayed on its own "card." If you don't see a card for NYU Brightspace, use the search function in the upper-right corner of the page. Click on the blue ribbon to add NYU Brightspace to your favorites.

Enter NYU Brightspace by clicking "GO."

NYU Brightspace displays a link for each of your classes on the lower left side of the page. Click on the link for your class.

Professors at NYU School of Law organize their class websites in many different ways. You will want to explore the website for each of your classes to understand how your professor has organized the site. Most professors rely heavily on "Content" and "Announcements."

"Online" classes within the Graduate Tax Program do not require real-time participation in class meetings; instead, you will gain access to recordings of classes that have taken place on campus (or in a professional studio) during the current semester or a previous semester. "Online" classes recorded between Spring 2020 and Spring 2022 may include recordings of classes that met on Zoom (due to COVID-19).

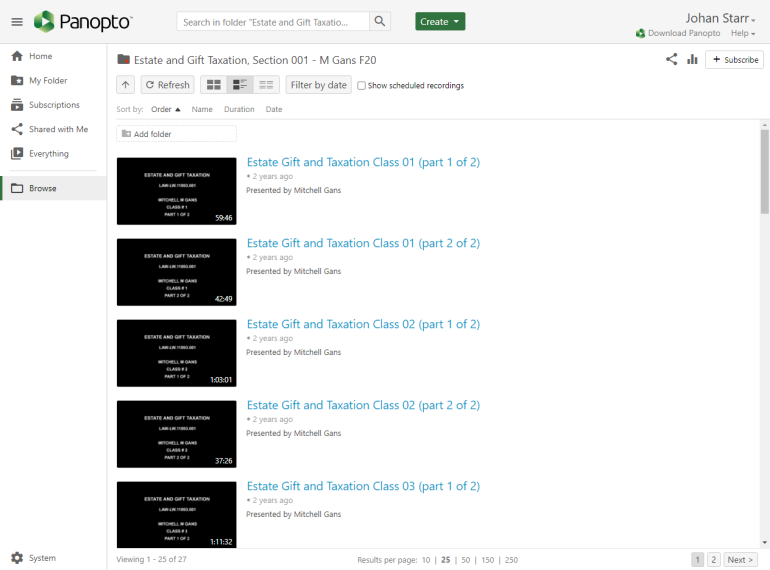

To access class recordings from your class website, click on "More Tools" and then "Panopto Course Folder." Panopto, our platform for hosting class recordings, will launch.

The recordings will be labeled by class number, date, or both. Please note that Panopto defaults to 25 recordings per page. There may be additional class recordings on a second page.

If you have any questions, please feel free to reach out to the Graduate Tax Program at (212) 998-6150 or law.taxprograms@nyu.edu.

-

Textbooks

-

There are a few different ways to identify required and optional textbooks:

• Search the NYU Bookstore textbook database

• Refer to the course syllabus

• Check the NYU Brightspace course website (if it is published and you are registered for the course)

• Contact the professor or the professor’s assistant (listed in the NYU Law directory)In addition to specific course textbooks, you will likely need to buy (or borrow) a paper set of the full two-volume code and six-volume regulations. You may already have a set at work, or you can pick up a print copy of the most recent edition.

CCH Tax Law is publishing the Winter 2022 version of the code (ISBN: 9780808053606) and the regulations (ISBN: 9780808053637) on 2/14/2022. If you want to wait to purchase the most recent version, you can use RIA checkpoint or another online source to get through the first few weeks of classes.

A few courses may also suggest an abridged version of the Code and Regs, which you are free to buy as well, though you will eventually need a full set of Code and Regs.

Many course exams do not allow access to the internet during the test, so e-books and internet-based versions of the code may not be accessible during exams. Apart from exams, you can use an e-book version of the code and regulations when preparing for class or in class, or you can use an internet-based version of the Code and Regs (e.g., RIA checkpoint which is accessible via our law library catalog)

You can buy your books via the NYU Bookstore or through other sources if it is cheaper or easier. Simply copy and search for the book online using the ISBN number.

Attendance

Rules of the American Bar Association, the New York State Court of Appeals, other state high courts and the Law School itself all require regular attendance. For online classes, we track attendance by examining the records of which videos students have viewed. Failing to view enough class videos can result, without further warning, in: 1) grade lowering or 2) denial of permission to complete coursework and/or sit for the exam, and receipt of a grade of WD or F/AB.

Missing more than one-fifth of the classes or videos for any course is presumptively excessive. Any student who finds themself at risk of this should immediately speak with the instructor and/or the director of the tax program and explain the situation.

In general, tax faculty members may establish a higher standard of regular attendance than that described above, and may also take attendance, class participation, and the quality of class performance into account in determining the student's grade (regardless of whether participation was mentioned as a grading factor in the first class meeting or syllabus). All that said, for many online-only courses there is little expectation of participation other than viewing the class videos and taking the exam.

Accommodations

Please visit the School of Law website on Academic Accommodations & Accessibility Support.

Students in need of accommodation should contact the Moses Center, 240 Greene Street, Fourth Floor, at (212) 998-4980. To preserve anonymity, students should not discuss accommodations with the course instructor.

For Non-Degree Students

Obtaining Your Net ID

Once you submit a registration form to the Graduate Tax Program, it may take up to 15 business days for your record/student account to be created/activated, at which point you will be officially registered for your courses. The Office of Records and Registration or the Graduate Tax Program will write to you at the email address provided on your registration form to let you know when you have been officially registered. We will provide you with a NetID and a University ID (called the “N number”, i.e., N12346789), along with additional information on NYU systems.

Course Selection

Many of the online courses are in advanced topics intended for those who have previously studied tax with us or those who are working in tax law. We do offer some courses which, while still very challenging, are good starting points. Please contact John Stephens, Director of the Graduate Tax Program by emailing john.stephens@nyu.edu or calling (212) 998-6394 to discuss.

Auditing

Most students take our courses for academic credit and earn a letter grade. However, it is also possible to audit a course. Auditing requires attending the class sessions and participating in class, or alternatively, watching a course online. However, auditors do not sit for the exam and don’t receive a grade or any academic credit. Auditing incurs the same cost as taking a class for credit. Auditors receive a transcript with a grade of “R.”

Transfer Credit

JD or LLM students from other law schools should contact their home school to determine its transfer credit policy, including whether an online course will be accepted for credit. A non-matriculated student has the option to take summer classes for a letter grade, and if the student receives a C or better, he or she may apply to have the credits earned count towards an NYU School of Law LLM degree or certificate, should the student be admitted into a degree or certificate program at a later date. (The first graduate tax course taken at NYU begins an admitted student’s five year period of study for an LLM degree.) A JD student at another school who takes an on campus course at NYU who is later admitted to a Tax LLM program at NYU may apply that credit towards their LLM program as advanced standing. However, the credit must fall within the five year period of study. (In other words, they would not be able to use that credit if they do not complete the remaining LLM credits within five years of taking that summer course.)

Required notices regarding distance learning classes taken by Texas residents who are not enrolled in a degree program:

- New York University School of Law is not regulated in Texas under Chapter 132 of the Texas Education Code;

- NYU is approved and regulated by the New York State Department of Education, and the Law School is also regulated by the NY State Court of Appeals; and

- The New York State Department of Education can be contacted at: (518) 474-3852. The Court of Appeals can be contacted at: (518) 455-7700.