Tillinghast Lecture explores the post-apartheid reform of South Africa’s tax system

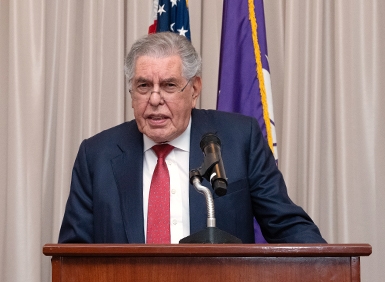

In 1994, shortly after the historic elections that ended apartheid in South Africa, the country’s new president, Nelson Mandela, asked corporate attorney Michael Katz to chair a commission to overhaul the South African tax system. Thirty years later, in the 26th annual David R. Tillinghast Lecture on International Taxation, Katz, now chair of law firm ENSAfrica, described the work of designing a fairer, more modern tax system in an economy challenged by widespread poverty, inequality, and a decade of high inflation and stagnant growth.

“The major reform that we recommended was internationally competitive rates—marginal, corporate,” Katz said in his September 25 remarks. “And how did we do that? The major method of doing that was to broaden the base. Everyone was brought into the system, [including] state-owned enterprises, and almost all tax incentives were eliminated.”

Watch the full video of the 2024 Tillinghast Lecture:

Selected quotes from the Tillinghast Lecture:

“There had to be a balance between taxes.… An indirect tax—that is very reliable, a good stream of revenue, but it’s very regressive. It bites on the poor hardest, it’s a consumption tax. And there, the challenge in South Africa of having a significant consumption tax is vast. We recommended [it], and that is a big component today of the totality of the tax collection in South Africa, but we were steadfast it should never exceed 14 percent.” [video 26:25]

“We consulted the then-Secretary of the Treasury here [in the United States], I think it was Robert Rubin. And the one principle I’ll never forget, he said, ‘Don’t give an interest deduction on home loans, mortgages.’ He said, ‘It’s the third biggest tax expenditure in the United States and don’t be tempted to do that.’ And we had many representations that we should do that, but it’s self-defeating, because the minute you give that deduction, it pushes up the value of the land so [people] then can’t afford it. So it makes no sense.” [video 40:54]

“One of our most important—and to me the most important—recommendation was the total elimination of tax incentives. Tax incentives [are] very popular, but really, economically, don’t serve a purpose. And whenever one evaluates a new project, it must be viable on a pre-tax basis. If it’s only viable on a post-tax basis, then it results in a misallocation of resources.” [video 44:15]

Posted October 10, 2024