Analysis

The Securities Enforcement Empirical Database (SEED) currently provides data for SEC actions initiated against public companies traded on major U.S. exchanges and their subsidiaries. We define public companies as companies with security prices that are tracked by the Center for Research in Security Prices.

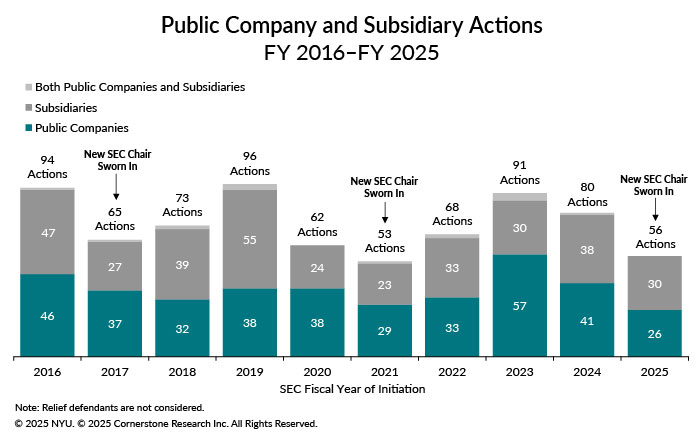

The SEC filed 56 new enforcement actions against public companies and subsidiaries in FY 2025, a decrease of 30 percent from FY 2024.

See color accessible chart. See full text description.

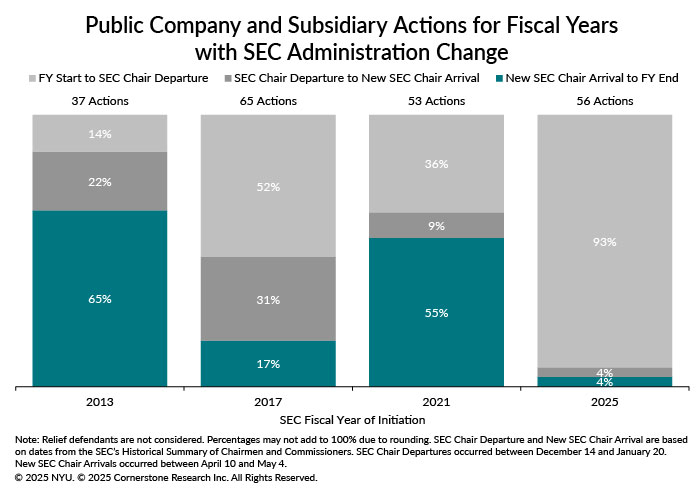

There have been four changes in SEC administration since FY 2010 (the first fiscal year in SEED). FY 2025 had the highest percentage (93%) of total actions initiated prior to an SEC administration change and the lowest percentage (4%) of total actions initiated under the newly sworn in Chair in a fiscal year in SEED.

See color accessible chart. See full text description.

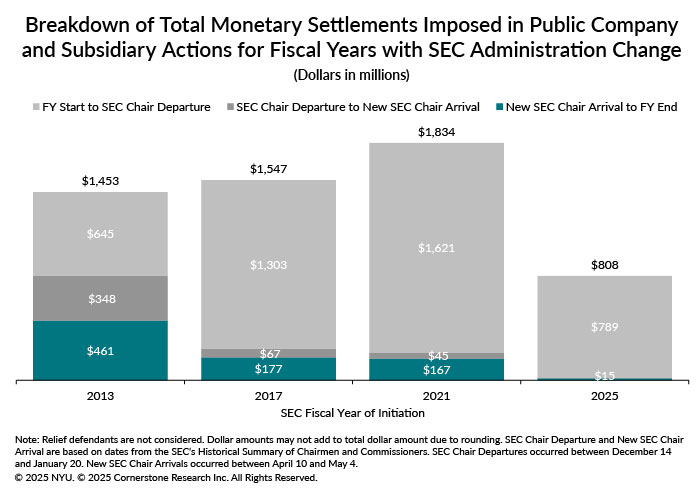

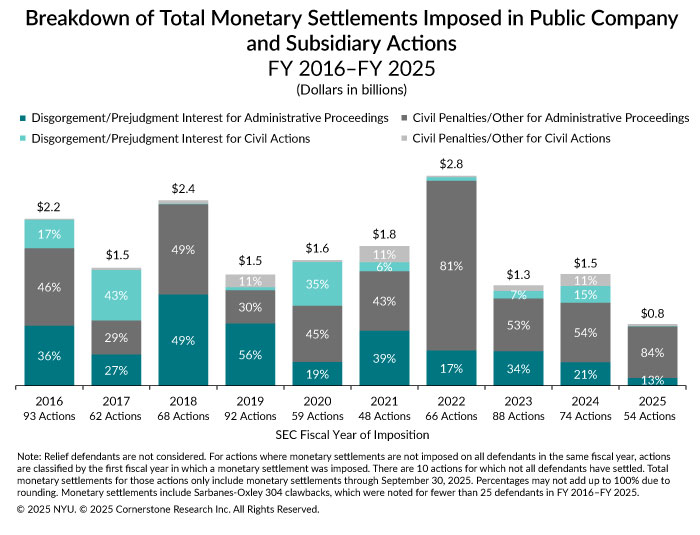

FY 2025 had the lowest total monetary settlements ($808 million) in a fiscal year with a change in SEC administration in SEED.

See color accessible chart. See full text description.

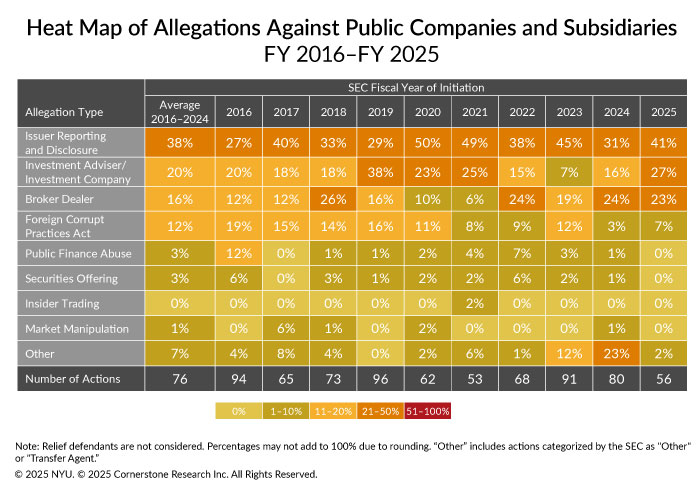

SEED tracks the type of allegation the SEC makes in each enforcement proceeding. In FY 2025, Issuer Reporting and Disclosure allegations were the most common allegation type (41%) of all actions filed against public companies and subsidiaries. Investment Adviser and Investment Company allegations were the second most common action, accounting for 27 percent of the actions filed.

See color accessible chart. See full text description.

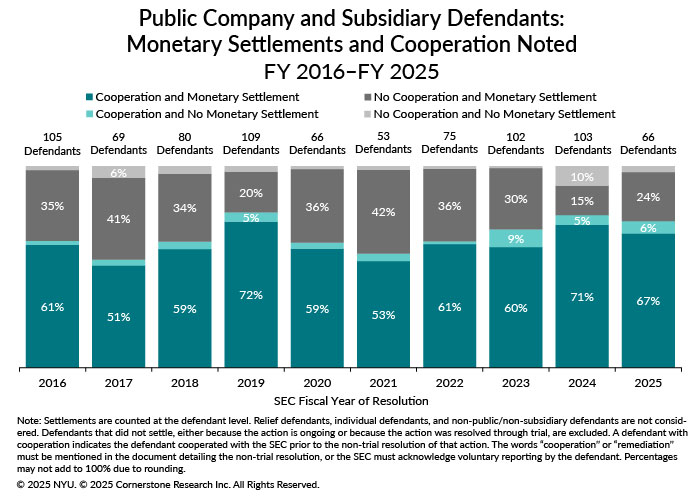

In FY 2025, the SEC noted cooperation by 73 percent of public company and subsidiary defendants, the second highest level since FY 2019. Of the cooperating defendants that settled, 6 percent had no monetary settlements imposed.

See color accessible chart. See full text description.

Disgorgement and prejudgment interest in civil actions, as a percentage of total monetary settlements imposed in public company and subsidiary actions, was less than 1 percent in FY 2025, the second lowest percentage in a fiscal year in SEED.

See color accessible chart. See full text description.

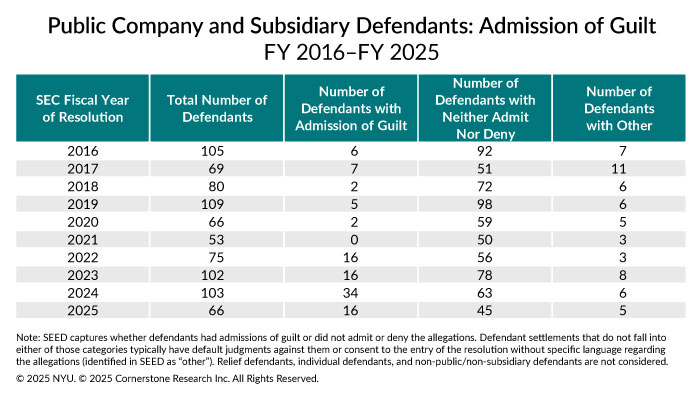

SEED also includes data on admissions of guilt. SEED considers a defendant to have an admission of guilt if the admission is in the SEC action, as opposed to a parallel action. In FY 2025, there were 16 public company or subsidiary defendants with admissions of guilt.

See color accessible chart. See full text description.

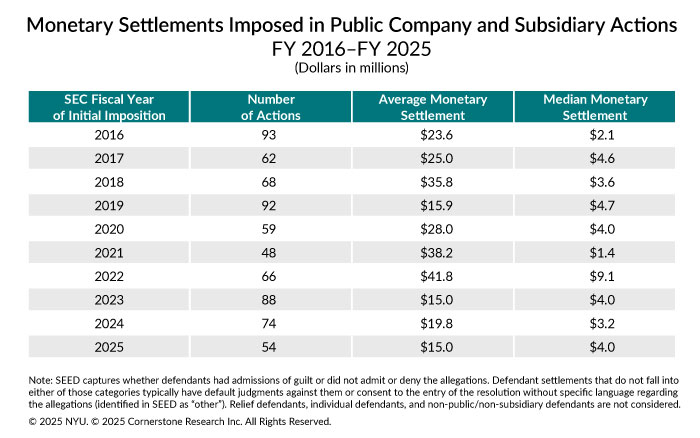

Monetary settlements imposed in public company and subsidiary actions totaled $0.8 billion in FY 2025, $0.7 billion less than in FY 2024. The median monetary settlement increased to $4.0 million in FY 2025, higher than the median of $3.2 million in FY 2024.