SEED Database

The Securities Enforcement Empirical Database (SEED) tracks and records information for SEC enforcement actions filed against public companies traded on major U.S. exchanges and their subsidiaries.

Created by the NYU Pollack Center for Law & Business in cooperation with Cornerstone Research, SEED facilitates the analysis and reporting of SEC enforcement actions through regular updates of new filings and settlement information for ongoing enforcement actions. The variables tracked include defendant names and types, violations, venues, and resolutions.

“Our goal is to shed light on the SEC’s securities law enforcement decisions. SEED is the first public database to provide easily searchable and verified data to researchers, counsel, and corporations, as well as regular reports on developments and trends.”

—Professor Stephen Choi, Co-Director of the Pollack Center for Law & Business.

Pollack Center for Law & Business

For press inquiries about NYU, please contact Michael Orey at Michael.Orey@nyu.edu.

For information about this site, including access for academic scholars, please contact law.seed@nyu.edu.

Cornerstone Research

For press inquiries about Cornerstone Research, please contact Elisabeth Gaubinger at egaubinger@cornerstone.com.

For information about Cornerstone Research materials on this site, please contact sec_research@cornerstone.com.

See color accessible chart. See full text description.

SEC Enforcement Activity: Public Companies and Subsidiaries (November 2025)

Key takeaways from the SEED research report for FY 2025 include:

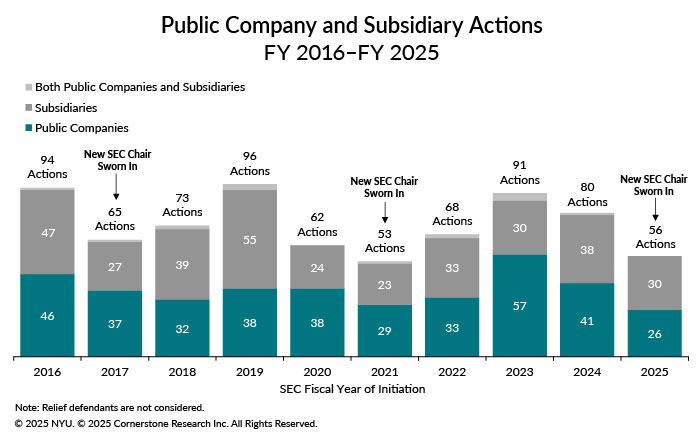

- New actions against public companies and subsidiaries decreased to 56 actions in FY 2025. This is 30% lower than FY 2024.

- FY 2025 had the highest percentage (93%) of total actions initiated prior to an SEC administration change and the lowest percentage (4%) of total actions initiated under the newly sworn in Chair in SEED.

- The SEC initiated nine actions in January as part of Chair Gensler’s off-channel communications sweep—an area that Chair Atkins indicated interest in addressing in remarks made in October 2025.

- Three of the four actions initiated against public companies and subsidiaries after Chair Gensler’s departure involved Issuer Reporting and Disclosure allegations. This is expected to continue into FY 2026. In May 2025 remarks, Chair Atkins signaled his administration would “return” to the “core mission that Congress set” for the SEC—prioritizing “protecting investors; furthering capital formation; and safeguarding fair, orderly, and efficient markets.”

- SEC monetary settlements in these actions totaled $0.8 billion, $0.7 billion less than in FY 2024 and the lowest since FY 2012. The total amount of disgorgement and prejudgment interest ($108 million) was the lowest in any fiscal year in SEED—more than $300 million below the next-lowest total in FY 2012. Civil penalties for administrative proceedings accounted for the highest percentage of the total monetary settlement for any fiscal year in SEED.

- The SEC noted cooperation by 73% of public company and subsidiary defendants in actions settled in FY 2025, the second highest level since FY 2019.

Prior SEED and Cornerstone Research Reports

This project is a collaboration between these organizations: